Stagnant wages and prices rising from corporate gougeflation are not tough enough on America’s lowest wage earners. So, here comes Sen. Rick Scott (R-FL) with a proposal to target and tax the 47 percent of Americans who currently don’t earn enough money to pay taxes.

Right, the Republicans who killed the plan last year to make sure the wealthiest people paid something/anything in taxes want to shift the burden to the poor.

Doing a little better yourself? The Associated Press reported over the weekend that “Mike Gibbons, a leading Republican Senate candidate from Ohio, said at a media event last fall that middle-class Americans don’t pay ‘any kind of a fair share’ of income taxes.”

Just don’t tax the fat cats.

President Joe Biden has again proposed a new minimum tax for the wealthiest Americans in his 2023 budget.

CNN reports that the Billionaire Minimum Income Tax “would assess a 20 percent minimum tax rate on U.S. households worth more than $100 million. Over half the revenue could come from those worth more than $1 billion.”

Will Rogers observed long ago: “”People want just taxes more than they want lower taxes. They want to know that every man is paying his proportionate share according to his wealth.”

That’s not the case today, when many who should be in the highest tax brackets are not even there since the tax laws have been written to protect them.

Last month, Jake Johnson of Common Dreams reported Wall Street bonuses “jumped 20 percent in 2021 “as big banks reported huge profits despite widespread havoc caused by the coronavirus pandemic.”

He also pointed out, “Taking the new figures into account, Sarah Anderson of the Institute for Policy Studies notes in a report that the average Wall Street bonus has soared by 1,743 percent since 1985.” Johnson added that, “if the federal minimum wage had grown at the same rate as Wall Street bonuses over the past three and a half decades, it would currently be $61.75 an hour instead of $7.25.”

This answers another pondering by our Oologah Oracle: “The difference between our rich and poor grows greater every year. Our distribution of wealth is getting more uneven all the time. A man can make a million and he is on every page in the morning. But it never tells you who gave up that million he got.”

Yeah, today’s robber barons need to Up Pay (for their workers) and Pay Up (their fair share of the taxes).

Sitting atop the money pile, the Americans for Tax Fairness in March found, “The rising asset values billionaires have enjoyed over the past two years are not taxable unless the assets are sold….But billionaires don’t need to sell assets to benefit from their increased value: they can live off money borrowed at cheap rates secured against their rising fortunes. And when all those wealth gains are passed along to the next generation, they entirely disappear for tax purposes.”

Thom Hartman, whose Hartman Report was reprinted at Common Dreams, adds, that calling for increasing taxes on the poorest among us isn’t enough for Sen. Scott, he also proposes to subject all legislation to sunset laws, which would give Republicans a chance every five years to kill Social Security and Medicare.

So, while preparing your tax returns, remember that Democrats think everyone should pay a fair share and Republicans want to protect their donor/owners and put the load of funding government on the backs of everyone else.

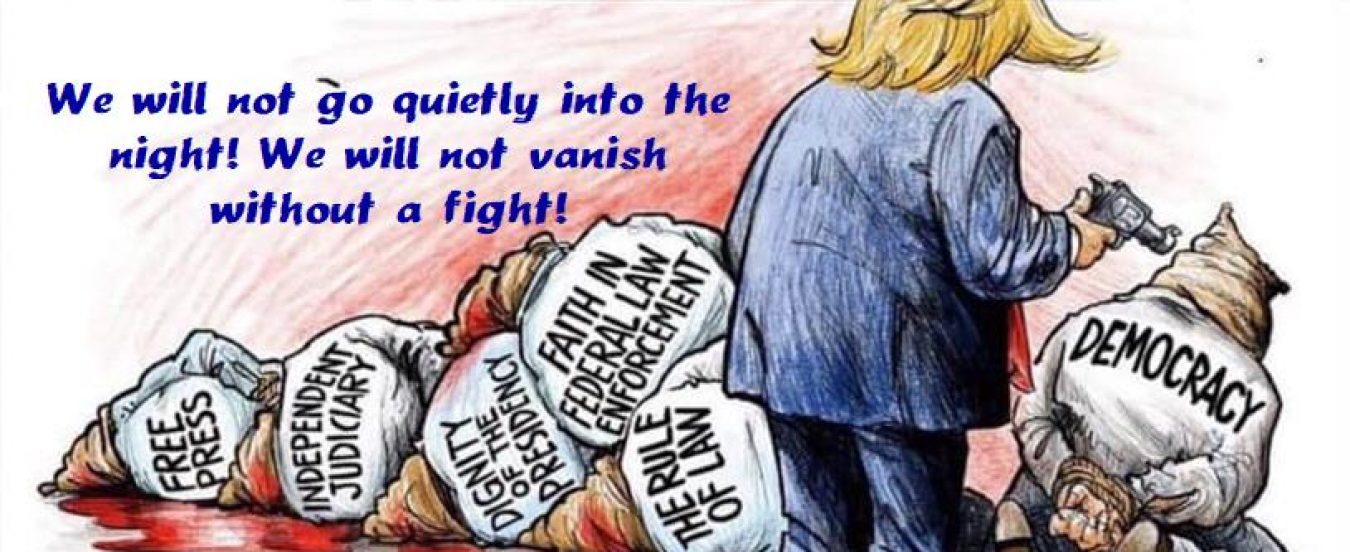

Expect another hard fight from Republicans to protect corporate greed at your expense.

(Gary Edmondson is chair of the Stephens County Democratic Party. Longer versions of his columns can be found at scdpok.us or facebook.com/SCDPOK/.)